Unlocking the Secrets to the Best Loan Rate: Your Ultimate Guide to Finding Affordable Financing

#### Best Loan RateWhen it comes to borrowing money, whether for a home, a car, or personal expenses, securing the **best loan rate** is crucial. A lower in……

#### Best Loan Rate

When it comes to borrowing money, whether for a home, a car, or personal expenses, securing the **best loan rate** is crucial. A lower interest rate can save you thousands of dollars over the life of a loan, making it essential to understand how to find the most favorable terms available. This guide will walk you through the factors that influence loan rates, tips for improving your chances of getting the best rate, and where to look for the best loan options.

#### Understanding Loan Rates

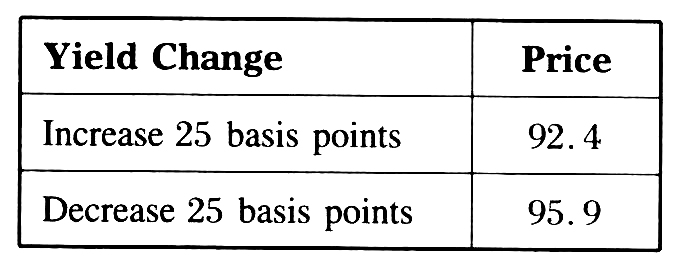

Loan rates are influenced by various factors, including your credit score, the type of loan you are seeking, and the current economic climate. Lenders assess your creditworthiness to determine the risk of lending you money. A higher credit score typically translates to a lower interest rate, while a lower score may result in higher rates or even loan denial.

Additionally, the type of loan plays a significant role in determining the rate. For instance, secured loans, which are backed by collateral, often have lower rates compared to unsecured loans. Understanding these nuances can help you make informed decisions when applying for loans.

#### Improving Your Chances of Getting the Best Loan Rate

1. **Check Your Credit Score**: Before applying for a loan, obtain a copy of your credit report and check your credit score. If your score is lower than you’d like, consider taking steps to improve it, such as paying off debts, making payments on time, and disputing any inaccuracies on your report.

2. **Shop Around**: Different lenders offer varying rates, so it’s essential to compare offers from multiple financial institutions. Use online comparison tools to easily evaluate loan rates from banks, credit unions, and online lenders.

3. **Consider the Loan Term**: Loan terms can affect your interest rate. Generally, shorter-term loans come with lower rates but higher monthly payments. Conversely, longer-term loans may have higher rates but lower monthly payments. Assess your financial situation to determine the best option for you.

4. **Negotiate**: Don’t hesitate to negotiate with lenders. If you receive a better offer from one lender, use it as leverage to negotiate a lower rate with another lender.

5. **Maintain a Stable Income**: Lenders prefer borrowers with a steady income. If you can demonstrate job stability and a reliable income source, you may be more likely to secure a favorable rate.

#### Where to Find the Best Loan Rate

1. **Credit Unions**: Often, credit unions offer lower rates than traditional banks because they are member-owned and focus on serving their members rather than maximizing profits.

2. **Online Lenders**: The rise of online lending platforms has increased competition in the market, often resulting in better rates for borrowers. Research reputable online lenders and read reviews to find the best options.

3. **Local Banks**: Don’t overlook local banks. They may offer competitive rates and personalized service that larger institutions cannot provide.

4. **Government Programs**: Explore government-backed loan programs that offer lower rates for specific demographics, such as first-time homebuyers or veterans.

#### Conclusion

Finding the **best loan rate** is a critical step in managing your finances effectively. By understanding how loan rates work, improving your creditworthiness, and exploring various lending options, you can secure a loan that meets your needs without breaking the bank. Remember, the key is to do your research, compare offers, and be proactive in your approach to borrowing. With the right strategies, you can unlock the best loan rates available and achieve your financial goals.