"Finding the Best Online Installment Loans Direct Lenders for Your Financial Needs"

#### Online Installment Loans Direct LendersIn today's fast-paced financial landscape, many individuals find themselves in need of quick access to funds. On……

#### Online Installment Loans Direct Lenders

In today's fast-paced financial landscape, many individuals find themselves in need of quick access to funds. One popular solution is through online installment loans direct lenders. These loans offer a convenient way to borrow money while allowing borrowers to repay in manageable installments over time. But what exactly are online installment loans, and how can you find the right direct lender for your needs?

#### Understanding Online Installment Loans

Online installment loans are a type of personal loan that allows borrowers to receive a lump sum of money upfront, which they then repay in fixed monthly installments. These loans can be used for various purposes, such as consolidating debt, covering unexpected expenses, or financing large purchases. The key advantage of online installment loans is their flexibility and accessibility, as many lenders operate entirely online, making the application process quick and straightforward.

#### The Role of Direct Lenders

When searching for online installment loans direct lenders, it’s essential to understand the distinction between direct lenders and third-party brokers. Direct lenders provide funds directly to borrowers, eliminating the need for intermediaries. This direct relationship can lead to a more streamlined borrowing process, often resulting in faster approvals and funding. Additionally, dealing directly with a lender can offer more transparency regarding loan terms and conditions.

#### Benefits of Choosing Direct Lenders

1. **Faster Processing Times**: Direct lenders typically have a more efficient application and approval process. Many offer instant decisions, allowing borrowers to access funds quickly.

2. **Transparent Terms**: Working directly with a lender often means clearer communication regarding interest rates, fees, and repayment terms. This transparency can help borrowers make more informed decisions.

3. **Tailored Solutions**: Direct lenders may offer a wider range of loan products, allowing borrowers to find a solution that best fits their financial situation.

4. **Building Relationships**: Establishing a relationship with a direct lender can be beneficial for future borrowing needs. A good track record with a lender can lead to better terms on future loans.

#### How to Find the Right Direct Lender

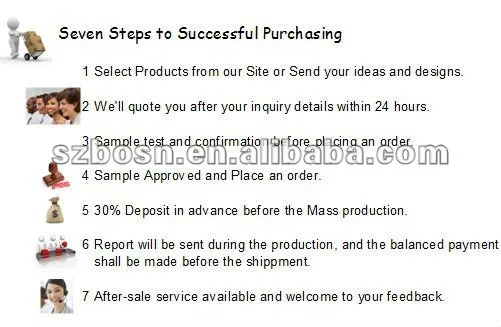

Finding the right online installment loans direct lenders requires some research and consideration. Here are some steps to guide you in your search:

1. **Research Lenders**: Start by researching various direct lenders online. Look for reviews and ratings from previous borrowers to gauge their reputation.

2. **Compare Loan Offers**: Once you have a list of potential lenders, compare their loan offers. Pay attention to interest rates, fees, and repayment terms.

3. **Check for Licensing**: Ensure that the lender is licensed to operate in your state. This is crucial for protecting your rights as a borrower.

4. **Read the Fine Print**: Before committing to a loan, carefully read the terms and conditions. Make sure you understand all fees and penalties associated with the loan.

5. **Consider Customer Service**: Good customer service can make a significant difference in your borrowing experience. Reach out to lenders with any questions you may have before applying.

#### Conclusion

In conclusion, online installment loans direct lenders offer a viable solution for individuals seeking quick financial relief. By understanding the benefits of direct lending and taking the time to research and compare options, borrowers can find the right loan to meet their needs. Remember to always borrow responsibly and ensure that any loan you take on is manageable within your budget. With the right approach, online installment loans can be a powerful tool for achieving your financial goals.