Unlock Your Home's Potential: A Comprehensive Guide to Citizens Bank Home Equity Loan

Guide or Summary:Definition of Home Equity LoanHow Does Citizens Bank Home Equity Loan Work?Competitive Interest RatesFlexible Loan AmountsEasy Application……

Guide or Summary:

- Definition of Home Equity Loan

- How Does Citizens Bank Home Equity Loan Work?

- Competitive Interest Rates

- Flexible Loan Amounts

- Easy Application Process

- Step-by-Step Application Process

#### Introduction

Are you a homeowner looking to tap into the equity of your property? The **Citizens Bank Home Equity Loan** is a powerful financial tool that allows you to leverage the value of your home for various needs, from home renovations to debt consolidation. In this article, we will explore what a home equity loan is, the benefits of choosing Citizens Bank, and how to apply for this loan effectively.

#### What is a Home Equity Loan?

Definition of Home Equity Loan

A home equity loan is a type of loan that allows homeowners to borrow against the equity they have built up in their property. Equity is the difference between your home’s current market value and the amount you owe on your mortgage. For example, if your home is worth $300,000 and you owe $200,000 on your mortgage, you have $100,000 in equity.

How Does Citizens Bank Home Equity Loan Work?

When you apply for a **Citizens Bank Home Equity Loan**, the bank will assess your home’s value and your outstanding mortgage balance to determine how much you can borrow. This loan typically comes with a fixed interest rate, meaning your monthly payments will remain consistent throughout the loan term. You can use the funds for various purposes, including home improvements, education expenses, or even consolidating high-interest debt.

#### Benefits of Choosing Citizens Bank

Competitive Interest Rates

One of the standout features of the **Citizens Bank Home Equity Loan** is its competitive interest rates. Compared to personal loans or credit cards, home equity loans often have lower rates, making them an attractive option for borrowers.

Flexible Loan Amounts

Citizens Bank offers flexible loan amounts based on your home equity. Whether you need a small amount for minor repairs or a larger sum for a major renovation, you can find a loan amount that suits your financial needs.

Easy Application Process

Applying for a home equity loan with Citizens Bank is straightforward. The bank provides an online application process that is user-friendly, allowing you to submit your information quickly and efficiently. Additionally, their customer service team is available to assist you throughout the process.

#### How to Apply for a Citizens Bank Home Equity Loan

Step-by-Step Application Process

1. **Assess Your Home Equity**: Before applying, determine how much equity you have in your home. This will give you an idea of how much you can potentially borrow.

2. **Gather Necessary Documentation**: Prepare documents such as your mortgage statement, proof of income, and any other financial information that may be required.

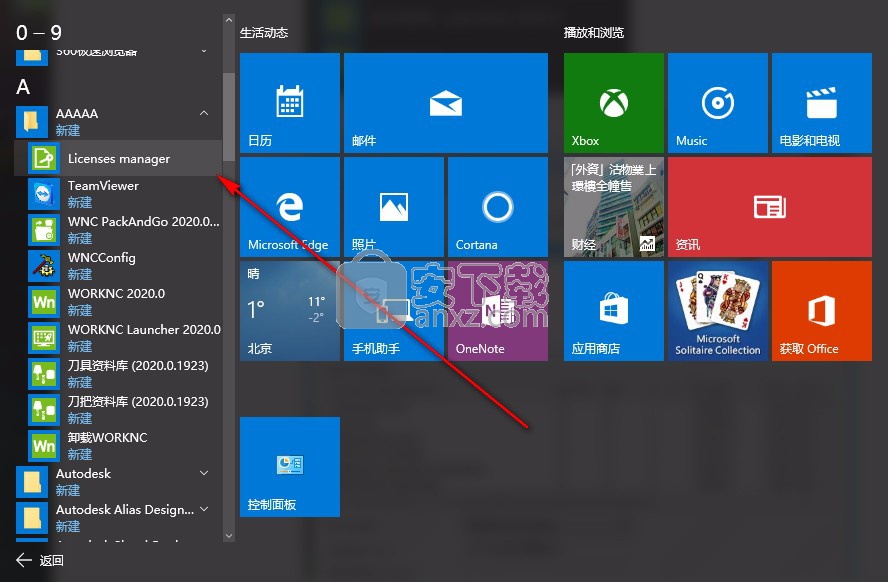

3. **Visit the Citizens Bank Website**: Navigate to the Citizens Bank website and find the home equity loan section. Here, you can start your application.

4. **Submit Your Application**: Fill out the online application form with accurate information. Once submitted, a representative will review your application.

5. **Receive Approval**: If approved, you will receive a loan offer detailing the terms, interest rate, and repayment schedule.

6. **Close the Loan**: After reviewing the offer, you can proceed to close the loan and receive your funds.

#### Conclusion

The **Citizens Bank Home Equity Loan** is a valuable resource for homeowners looking to access funds for various financial needs. With competitive rates, flexible amounts, and an easy application process, it stands out as a top choice for those considering a home equity loan. Whether you’re planning a home renovation, consolidating debt, or funding a major purchase, this loan can help you unlock the potential of your home’s equity. Don’t hesitate to explore your options and take the first step towards achieving your financial goals today!