Unlock Your Recovery Journey: Exploring the Best Loan for Rehab Options

Guide or Summary:Understanding Loan for RehabThe Importance of Financial Support in RehabilitationTypes of Loans Available for RehabilitationHow to Apply fo……

Guide or Summary:

- Understanding Loan for Rehab

- The Importance of Financial Support in Rehabilitation

- Types of Loans Available for Rehabilitation

- How to Apply for a Loan for Rehab

- Considerations When Choosing a Loan for Rehab

- The Benefits of Securing a Loan for Rehab

- Support Beyond Financial Assistance

- Conclusion: Taking the First Step Towards Recovery

**Translation of "loan for rehab":** 贷款用于康复

---

Understanding Loan for Rehab

When it comes to overcoming addiction or mental health challenges, many individuals find themselves in need of financial assistance to access the necessary rehabilitation services. This is where a **loan for rehab** comes into play. These loans are specifically designed to help individuals cover the costs associated with rehabilitation programs, whether they are inpatient or outpatient.

The Importance of Financial Support in Rehabilitation

Rehabilitation can be a crucial step towards recovery, but the financial burden can often be overwhelming. Many treatment centers require upfront payments, and insurance may not cover all the expenses. This is why understanding the various options for a **loan for rehab** is essential. These loans provide a financial lifeline, allowing individuals to focus on their recovery without the added stress of financial strain.

Types of Loans Available for Rehabilitation

There are several types of loans available for those seeking rehabilitation services. Personal loans, for instance, are often unsecured, meaning they do not require collateral. This can be an attractive option for individuals who may not have assets to put up as security. Additionally, some lenders offer specific loans tailored for medical or rehabilitation expenses, which may come with lower interest rates or more flexible repayment terms.

How to Apply for a Loan for Rehab

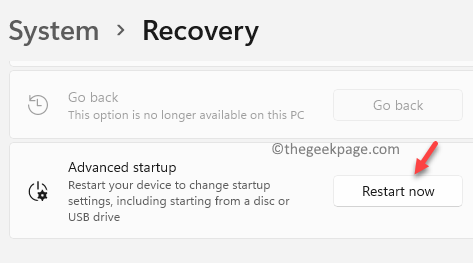

Applying for a **loan for rehab** typically involves a few straightforward steps. First, individuals should assess their financial situation and determine how much they need to borrow. Next, researching various lenders and their terms is crucial. Online comparison tools can help individuals find the best rates and terms that fit their needs. Once a suitable lender is found, the application process usually requires providing personal information, income details, and sometimes a credit check.

Considerations When Choosing a Loan for Rehab

When selecting a **loan for rehab**, it is essential to consider several factors. Interest rates can vary significantly between lenders, so it is wise to shop around. Additionally, individuals should look at the repayment terms, including the length of the loan and monthly payment amounts. Understanding the total cost of the loan over its lifetime is also crucial, as this can impact long-term financial health.

The Benefits of Securing a Loan for Rehab

One of the primary benefits of securing a **loan for rehab** is the ability to access necessary treatment without delay. Many individuals may hesitate to seek help due to financial concerns, but with a loan, they can take the first step towards recovery immediately. Furthermore, obtaining a loan can help individuals build or improve their credit scores if they make timely payments, which can be beneficial for future financial endeavors.

Support Beyond Financial Assistance

While a **loan for rehab** is a critical component of obtaining treatment, it is also essential to seek support beyond financial assistance. Many rehabilitation centers offer counseling services, support groups, and aftercare programs that can aid in the recovery process. Combining financial support with comprehensive treatment options can significantly enhance the chances of successful rehabilitation.

Conclusion: Taking the First Step Towards Recovery

In conclusion, a **loan for rehab** can provide the necessary financial support for individuals seeking to overcome addiction or mental health issues. By understanding the various options available, individuals can make informed decisions that will aid in their recovery journey. Remember, seeking help is a sign of strength, and with the right support, a brighter, healthier future is within reach.