"Unlock Your Benefits: How to Use the VA Home Loan Eligibility Calculator for Maximum Savings"

#### Understanding VA Home LoansVA home loans are a fantastic benefit provided to eligible veterans, active-duty service members, and certain members of the……

#### Understanding VA Home Loans

VA home loans are a fantastic benefit provided to eligible veterans, active-duty service members, and certain members of the National Guard and Reserves. These loans are backed by the U.S. Department of Veterans Affairs (VA), making them an attractive option for those looking to purchase a home. The primary advantages include no down payment, no private mortgage insurance (PMI), and competitive interest rates. However, not everyone is eligible for these loans, which is where the VA home loan eligibility calculator comes into play.

#### What is the VA Home Loan Eligibility Calculator?

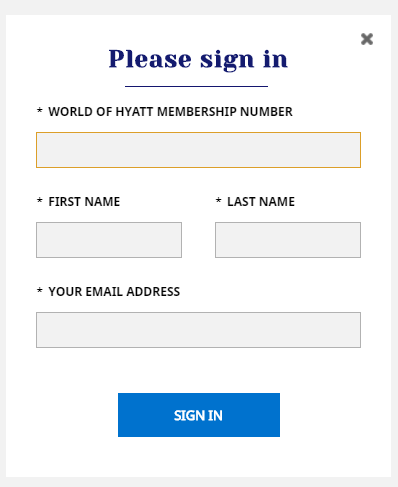

The VA home loan eligibility calculator is an online tool designed to help potential homebuyers determine their eligibility for a VA loan. By inputting specific information such as service history, income, and credit score, users can quickly assess whether they meet the criteria set forth by the VA. This tool is invaluable for veterans and service members, as it provides a clear picture of their options before they embark on the home-buying journey.

#### How to Use the VA Home Loan Eligibility Calculator

Using the VA home loan eligibility calculator is a straightforward process. Typically, users will need to provide the following information:

1. **Service History**: Indicate whether you are an active-duty service member, a veteran, or a member of the National Guard or Reserves. The length and type of service can affect eligibility.

2. **Income Information**: Enter your monthly or annual income. This helps determine your ability to repay the loan.

3. **Credit Score**: While the VA does not set a minimum credit score requirement, lenders usually have their own standards. Providing this information will give a better estimate of your eligibility.

4. **Loan Amount**: Input the estimated loan amount you wish to borrow. This can help gauge how much you can afford based on your financial situation.

After entering this information, the calculator will provide an immediate assessment of your eligibility, including any potential loan limits and benefits you may qualify for.

#### Benefits of Using the VA Home Loan Eligibility Calculator

1. **Time-Saving**: Instead of wading through lengthy documentation or waiting for a lender’s assessment, the calculator provides instant feedback.

2. **Informed Decisions**: Understanding your eligibility helps you make informed decisions about your home-buying options and financial planning.

3. **Budget Planning**: Knowing how much you can borrow allows you to set realistic expectations and budget accordingly.

4. **Access to Resources**: Many calculators also provide links to additional resources or local lenders specializing in VA loans, helping you take the next step in your home-buying journey.

#### Common Misconceptions About VA Loans

Many potential homebuyers have misconceptions about VA loans, believing they are only for first-time buyers or that the process is overly complicated. In reality, VA loans can be used multiple times, and the application process has become much more streamlined in recent years. The VA home loan eligibility calculator helps dispel these myths by providing clear, factual information.

#### Conclusion

The VA home loan eligibility calculator is an essential tool for veterans and service members looking to purchase a home. By helping users quickly determine their eligibility, it paves the way for informed financial decisions and a smoother home-buying process. If you are considering a VA loan, take advantage of this valuable resource to unlock your benefits and maximize your savings.