Applying for Loans: A Step-by-Step Guide

Guide or Summary:Researching Your OptionsAssessing Your Financial SituationPreparing Your ApplicationChoosing a LenderSubmitting Your ApplicationReceiving Y……

Guide or Summary:

- Researching Your Options

- Assessing Your Financial Situation

- Preparing Your Application

- Choosing a Lender

- Submitting Your Application

- Receiving Your Loan

- Managing Your Loan

Applying for loans is a common task for individuals and businesses alike. Whether you're seeking to finance a major purchase, consolidate debt, or simply build your credit score, understanding the process of applying for loans is crucial. This comprehensive guide will walk you through the essential steps of applying for loans, ensuring you navigate the process with confidence and ease.

Researching Your Options

The first step in applying for loans is to research your options. There are various types of loans available, including personal loans, auto loans, home loans, and business loans. Each type of loan has its own requirements, interest rates, and repayment terms. Take the time to understand the different types of loans available and determine which one best suits your needs.

Assessing Your Financial Situation

Before applying for a loan, it's essential to assess your financial situation. This involves evaluating your income, expenses, and overall financial health. Ensure that you have a clear understanding of your financial obligations and how much you can afford to repay each month. This will help you choose the right loan and avoid financial strain.

Preparing Your Application

Once you've researched your options and assessed your financial situation, it's time to prepare your application. This involves gathering all the necessary documents, including proof of income, identification, and financial statements. Be prepared to provide detailed information about your employment history, credit history, and any outstanding debts.

Choosing a Lender

When applying for loans, it's important to choose the right lender. Research different lenders and compare their interest rates, fees, and repayment terms. Consider factors such as the lender's reputation, customer service, and the availability of pre-approval options. Choosing the right lender can make a significant difference in the overall cost and ease of your loan application process.

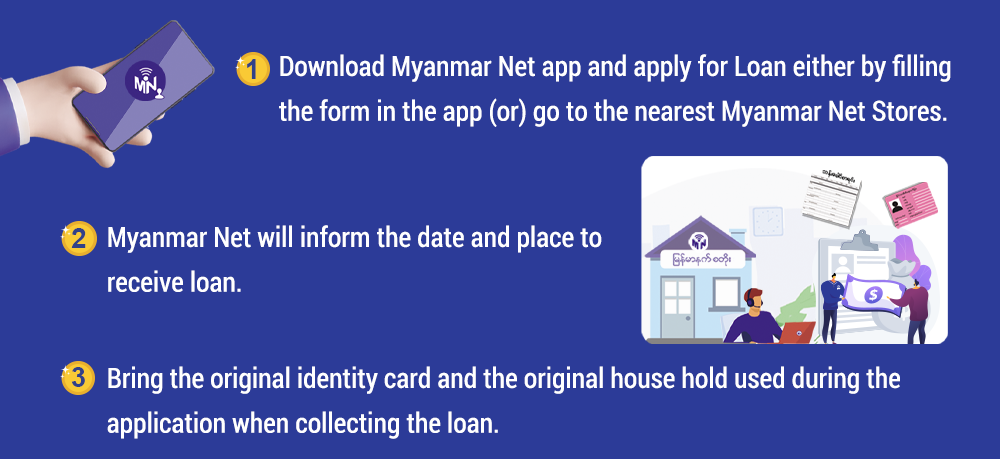

Submitting Your Application

Once you've prepared your application and chosen a lender, it's time to submit your application. This can be done online, by mail, or in person. Be sure to follow the lender's instructions carefully and provide all the required information. Keep a copy of your application for your records and track the status of your application through the lender's website or customer service.

Receiving Your Loan

After your application has been approved, it's time to receive your loan. This may involve setting up automatic payments, opening a new bank account, or receiving funds through a wire transfer. Be sure to read the terms and conditions of your loan carefully and understand your obligations as a borrower.

Managing Your Loan

Finally, managing your loan is an essential part of the process. Make sure to keep up with your payments and communicate with your lender if you encounter any issues. Regularly review your financial statements and make adjustments to your budget as needed. By managing your loan effectively, you can ensure that you stay on track and achieve your financial goals.

In conclusion, applying for loans can be a daunting task, but by following these essential steps, you can navigate the process with confidence and ease. Remember to research your options, assess your financial situation, prepare your application, choose the right lender, submit your application, receive your loan, and manage your loan effectively. With these steps in mind, you can successfully apply for loans and achieve your financial goals.