Para Loans: A Comprehensive Guide to Understanding and Utilizing Para Loans for Your Financial Goals

Guide or Summary:What are Para Loans?How Do Para Loans Work?Advantages of Para LoansDisadvantages of Para LoansPara loans are increasingly becoming a popula……

Guide or Summary:

Para loans are increasingly becoming a popular option for individuals and businesses looking to secure financing. These loans are tailored to meet the specific needs of borrowers, often offering more flexible terms and lower interest rates compared to traditional loans. This comprehensive guide will delve into the intricacies of para loans, providing valuable insights into how to understand and utilize them effectively to achieve your financial goals.

What are Para Loans?

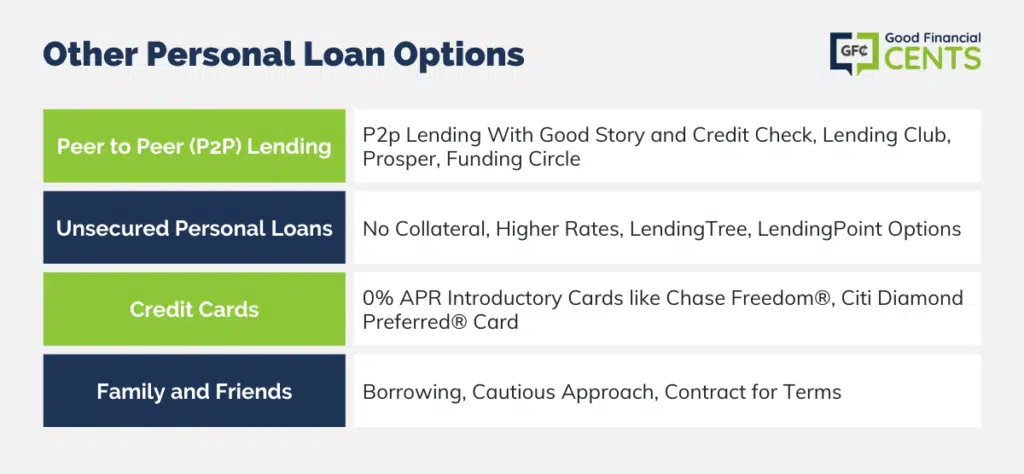

Para loans, also known as parallel loans or para-financing, are a type of alternative financing that operates outside the traditional banking system. Unlike conventional loans, which are typically secured by collateral and require a credit score, para loans are unsecured and often rely on the borrower's reputation and creditworthiness within their community or industry.

How Do Para Loans Work?

The process of obtaining a para loan is usually straightforward. Borrowers typically provide information about their financial situation, including their income, expenses, and credit history. This information is then used to determine the borrower's ability to repay the loan.

Once approved, the loan is typically disbursed in small, manageable amounts over a period of time. Repayment terms can vary, but they are generally flexible, allowing borrowers to make payments at their own pace.

Advantages of Para Loans

One of the main advantages of para loans is their flexibility. Unlike traditional loans, which often have rigid terms and conditions, para loans can be tailored to meet the specific needs of borrowers. This flexibility can be particularly beneficial for individuals and businesses looking to finance a range of projects, from starting a new business to funding a major renovation.

Another advantage of para loans is their lower interest rates. Because para loans are unsecured, they often come with lower interest rates than traditional loans. This can result in significant savings over the life of the loan, making para loans an attractive option for borrowers looking to minimize their borrowing costs.

Disadvantages of Para Loans

While para loans offer many advantages, they also come with some potential drawbacks. One of the main disadvantages is the lack of collateral, which can make them riskier for lenders. As a result, para loans may come with higher interest rates and fees than traditional loans.

Another potential drawback of para loans is the lack of regulatory oversight. Because para loans operate outside the traditional banking system, they are not subject to the same level of regulation as conventional loans. This can make them riskier for borrowers, as there is less protection in place if something goes wrong.

Para loans are a flexible and affordable financing option for individuals and businesses looking to achieve their financial goals. While they offer many advantages, it's important to carefully consider the potential risks and drawbacks before applying for a para loan. By doing so, borrowers can make informed decisions and maximize the benefits of this innovative financing option.