How to Effectively Manage Your Dave Ramsey Student Loan Debt: Proven Strategies for Financial Freedom

In today's world, student loans have become a significant burden for many young adults. However, with the right strategies and insights, you can take contro……

In today's world, student loans have become a significant burden for many young adults. However, with the right strategies and insights, you can take control of your Dave Ramsey Student Loan and pave your way to financial freedom. Dave Ramsey, a renowned financial expert, provides a wealth of knowledge on how to tackle debt effectively. This article will delve into his methods and offer practical steps to manage your student loan debt successfully.

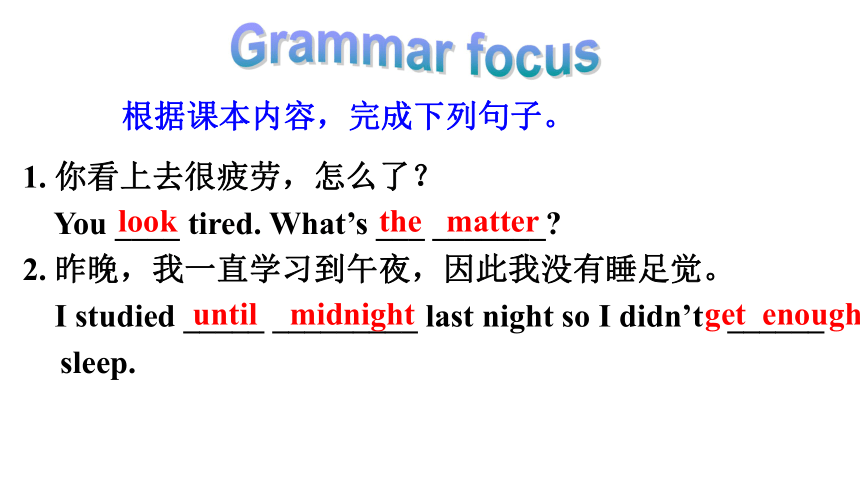

Dave Ramsey emphasizes the importance of budgeting and living within your means. The first step in managing your Dave Ramsey Student Loan is to create a comprehensive budget. This budget should outline all your income sources and expenses, allowing you to identify areas where you can cut back. By prioritizing your essential expenses and allocating funds towards your student loan payments, you can create a sustainable financial plan.

One of the key principles of Ramsey's philosophy is the "debt snowball" method. This approach encourages you to focus on paying off your smallest debts first, which can create a psychological boost as you see progress. While this method may not seem directly related to your Dave Ramsey Student Loan, it can help you build momentum and discipline in managing your overall debt. Once you've paid off smaller debts, you can redirect those payments towards your student loans, accelerating your repayment process.

Another critical aspect of managing your Dave Ramsey Student Loan is understanding your loan options. There are various repayment plans available, including income-driven repayment plans, which can adjust your monthly payments based on your income. However, Ramsey advises against extending the loan term just to lower monthly payments, as this can lead to paying more interest over time. Instead, focus on making extra payments when possible to reduce the principal balance and save on interest.

Additionally, Ramsey encourages individuals to build an emergency fund before aggressively paying off debt. This fund should ideally cover three to six months' worth of living expenses. Having this financial cushion can prevent you from accumulating more debt in case of unexpected expenses, allowing you to stay on track with your Dave Ramsey Student Loan repayment plan.

Moreover, consider exploring options for loan forgiveness or repayment assistance programs, especially if you work in public service or education. These programs can significantly reduce your overall loan burden, aligning with Ramsey’s goal of achieving financial peace.

Lastly, it's crucial to stay motivated and educated about your financial journey. Engage with communities or forums that discuss Dave Ramsey Student Loan strategies, and consider following Ramsey's podcasts or books for ongoing support and inspiration. Surrounding yourself with like-minded individuals can provide accountability and encouragement as you work towards becoming debt-free.

In conclusion, managing your Dave Ramsey Student Loan requires a combination of strategic planning, discipline, and education. By implementing Ramsey's principles, such as budgeting, the debt snowball method, and building an emergency fund, you can take control of your financial future. Remember, the journey to financial freedom is a marathon, not a sprint. Stay committed to your goals, and you will find yourself on the path to a debt-free life.