Unlock Your Dream Home: Understanding Income Eligibility for USDA Home Loans

Guide or Summary:What is USDA Home Loan Income Eligibility?How to Calculate Income Eligibility for USDA Home LoansBenefits of USDA Home LoansConclusion: Is……

Guide or Summary:

- What is USDA Home Loan Income Eligibility?

- How to Calculate Income Eligibility for USDA Home Loans

- Benefits of USDA Home Loans

- Conclusion: Is a USDA Home Loan Right for You?

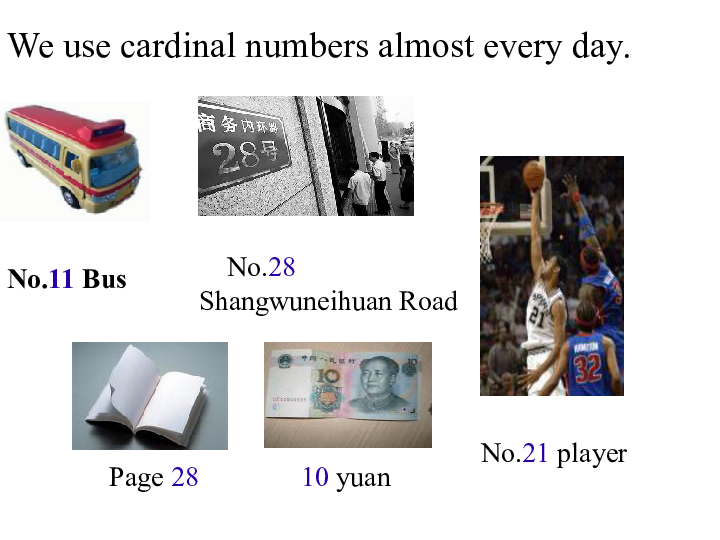

When it comes to homeownership, the USDA home loan program stands out as a beacon of hope for many aspiring homeowners, especially those in rural areas. The program is designed to promote homeownership in less densely populated regions, offering low-interest rates and no down payment options. However, one of the critical factors that potential applicants must understand is the income eligibility for USDA home loans. This aspect plays a significant role in determining whether you qualify for this advantageous loan program.

What is USDA Home Loan Income Eligibility?

USDA home loans are backed by the United States Department of Agriculture and are aimed at assisting low to moderate-income families in purchasing homes in eligible rural areas. The income eligibility criteria for these loans are primarily based on the median income levels of the area in which you plan to buy a home. Generally, your household income must not exceed 115% of the median income for your area.

To determine your eligibility, you will need to consider all sources of income, including wages, bonuses, overtime, and any additional income such as child support or alimony. It’s important to note that the USDA does not only look at your income but also evaluates your credit history and debt-to-income ratio, which can affect your overall eligibility.

How to Calculate Income Eligibility for USDA Home Loans

Calculating your income eligibility for USDA home loans involves a few straightforward steps. First, you need to identify the median income for your area. This information can typically be found on the USDA website or through local housing authorities. Once you have this figure, you can determine 115% of that median income, which will serve as your threshold for eligibility.

For example, if the median income for your area is $50,000, 115% of that would be $57,500. If your household income is below this amount, you may qualify for a USDA home loan. Additionally, the USDA takes into account the number of people in your household, as this can influence the median income limits.

Benefits of USDA Home Loans

The advantages of USDA home loans extend beyond just income eligibility. These loans come with several benefits that make them an attractive option for many homebuyers. Firstly, there is no down payment required, which can significantly lower the barriers to homeownership. Additionally, USDA loans offer competitive interest rates, often lower than those of conventional loans, which can save you thousands over the life of the loan.

Moreover, USDA loans have flexible credit requirements, making them accessible to individuals with less-than-perfect credit histories. This flexibility, combined with the income eligibility criteria, allows a broader spectrum of individuals to achieve their dream of homeownership.

Conclusion: Is a USDA Home Loan Right for You?

In summary, understanding the income eligibility for USDA home loans is crucial for anyone considering this financing option. By familiarizing yourself with the eligibility criteria and calculating your potential income limits, you can determine if you qualify for this beneficial program. With its numerous advantages, including no down payment and lower interest rates, a USDA home loan could very well be the key to unlocking the door to your dream home. If you believe you meet the income eligibility requirements, reach out to a USDA-approved lender to explore your options and take the first step toward homeownership today!