Understanding the Credit Score Needed for Home Loan Approval: Your Comprehensive Guide

#### Credit Score Needed for Home LoanWhen it comes to securing a home loan, one of the most critical factors lenders consider is your credit score. The cre……

#### Credit Score Needed for Home Loan

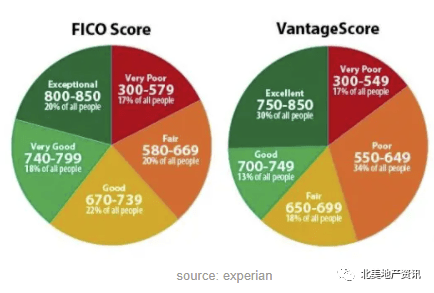

When it comes to securing a home loan, one of the most critical factors lenders consider is your credit score. The credit score needed for home loan approval can vary based on several factors, including the type of loan you are applying for and the lender's specific requirements. Generally, a credit score of 620 or higher is often considered the minimum for conventional loans. However, many lenders may offer options for those with lower scores, albeit at higher interest rates.

#### Why is Your Credit Score Important?

Your credit score serves as a reflection of your creditworthiness. It helps lenders assess the risk of lending you money. A higher credit score indicates that you have a history of managing your debts responsibly, which can lead to lower interest rates and more favorable loan terms. Conversely, a low credit score can limit your options and result in higher costs over the life of the loan.

#### Types of Loans and Their Credit Score Requirements

Different types of home loans come with varying credit score requirements. For instance:

1. **Conventional Loans**: As mentioned earlier, most conventional loans require a credit score of at least 620. However, to secure better rates and terms, aiming for a score of 740 or higher is advisable.

2. **FHA Loans**: The Federal Housing Administration (FHA) offers loans that are more forgiving of lower credit scores. You can qualify for an FHA loan with a credit score as low as 580, provided you can make a 3.5% down payment. If your score is between 500 and 579, you might still qualify, but a 10% down payment will be required.

3. **VA Loans**: If you are a veteran or active-duty service member, you may qualify for a VA loan, which typically does not have a minimum credit score requirement. However, most lenders prefer a score of at least 620.

4. **USDA Loans**: For those looking to buy in rural areas, USDA loans can be a great option. While there is no official minimum credit score, most lenders look for a score of at least 640.

#### Improving Your Credit Score

If your credit score falls below the necessary threshold for the credit score needed for home loan, don’t despair. There are several steps you can take to improve your score before applying for a loan:

- **Pay Your Bills on Time**: Your payment history makes up a significant portion of your credit score. Consistently paying your bills on time can have a positive impact.

- **Reduce Your Debt**: Aim to lower your credit card balances and other debts. A lower debt-to-income ratio can improve your score.

- **Check Your Credit Report**: Regularly review your credit report for errors. Disputing inaccuracies can help raise your score.

- **Limit New Credit Inquiries**: Each time you apply for credit, a hard inquiry is made, which can temporarily lower your score. Try to limit new applications before applying for a mortgage.

#### Conclusion

Understanding the credit score needed for home loan approval is crucial for potential homebuyers. By knowing the requirements for different types of loans and taking steps to improve your credit score, you can enhance your chances of securing a mortgage. Remember, a healthy credit score not only helps you qualify for a loan but also saves you money in interest over the life of your mortgage. Take the time to assess your financial situation, and don’t hesitate to seek professional advice if needed. Your dream home could be closer than you think!